Banqer is an innovative financial education platform designed to equip students with essential money management skills through interactive, real-world simulations. Think of it as online banking for students to use fake money with.

By integrating Banqer into the classroom, educators can provide students with a practical understanding of financial concepts, preparing them for future financial responsibilities.

Implementation in Schools

Banqer offers tailored programs for various educational levels:

- Banqer Primary: Aimed at Years 5 to 8, this program introduces students to fundamental financial concepts such as income, expenses, banking, and taxation. The platform employs videos, quizzes, and simulated events to make learning engaging and experiential. I use this one in my Year 5 classroom and the kids love it.

- Banqer High Junior and Senior: Designed for secondary school students, these programs delve deeper into topics like budgeting, careers, investments, and risk management. Through interactive modules, students build financial literacy in a controlled, simulated environment that mirrors real-world financial scenarios.

Utilising Banqer as a Reward System

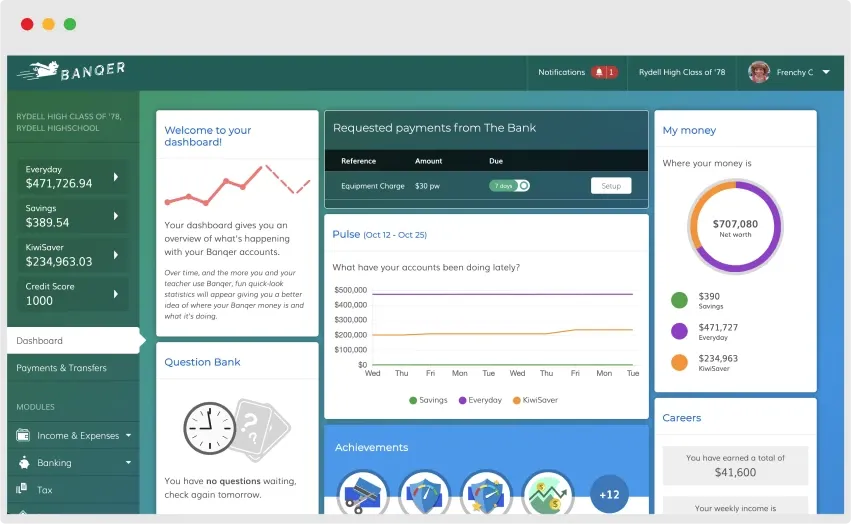

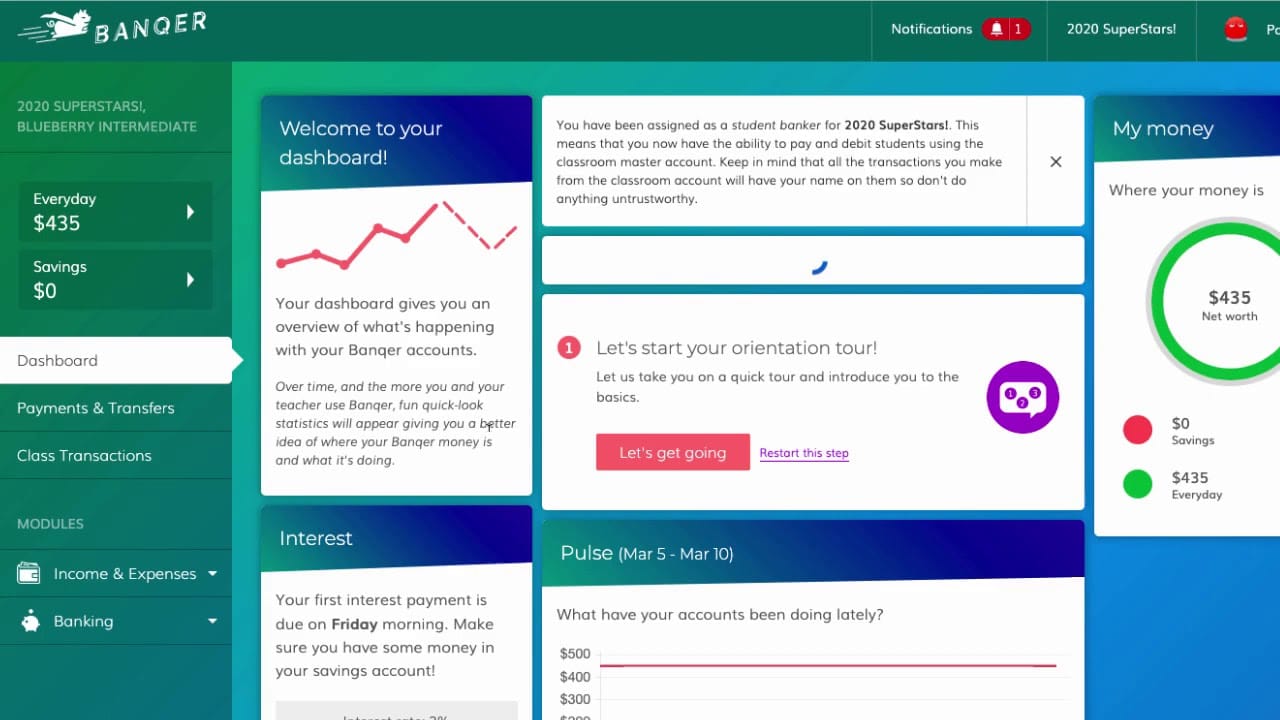

Teachers can leverage Banqer’s virtual economy to create a classroom reward system. By assigning virtual currency for positive behaviours, completed assignments, or classroom responsibilities, students can earn and manage their digital funds. They can then use their earnings to “purchase” privileges or classroom rewards, fostering an understanding of earning, saving, and spending within a controlled setting. This approach not only incentivises positive behaviour but also imparts crucial financial management skills.

Develop Internet Banking and Money Management Skills

Banqer’s platform simulates online banking experiences, allowing students to perform transactions such as transferring funds, setting up automatic payments, and monitoring account balances. This hands-on exposure helps students become comfortable with digital banking interfaces, understand the importance of account security, and develop responsible online financial habits. By navigating these simulations, students gain confidence in managing real-world online banking tasks.

Alternatives to Banqer

While Banqer offers a comprehensive solution for financial education, there are alternative money management resources available:

- Banzai: A free interactive financial education platform that teaches real-world finance and practical life skills through simulations and games. Banzai is used by over 120,000 teachers across more than 50% of U.S. schools.

- Kid’s Coin: A digital program that educates students about banking, online transactions, e-commerce, and taxes. Students earn, save, and spend virtual currency using simulated bank accounts, providing a practical understanding of financial management.

Integrating financial literacy tools like Banqer into the educational curriculum empowers students with the knowledge and skills necessary for responsible financial decision-making in the future.